Guarantee With Confidence: Discover Tailored Insurance Services for Unparalleled Satisfaction

Are you searching for insurance that is specifically developed to satisfy your one-of-a-kind requirements? Look no additionally. With our customized insurance solutions, you can guarantee with confidence and delight in unequaled comfort. We understand that every person's way of living is different, which is why we provide tailored insurance plans that fit your individual needs. Discover the benefits of tailored insurance coverage and locate the ideal insurance coverage company for you. Don't wait any longer - accomplish tranquility of mind with our detailed insurance coverage solutions.

Understanding Your Insurance Needs

You require to understand your insurance coverage needs to make sure that you can select the appropriate insurance coverage for your specific situation. Insurance is not a one-size-fits-all solution, and it's essential to examine your individual scenarios before making any kind of decisions. Start by examining the threats that you encounter in your specialist or personal life. Take into consideration factors such as your age, wellness, financial situation, and profession. Are you a homeowner? Do you possess an automobile? Do you have dependents? These are very important questions to ask yourself when establishing your insurance needs.

Finally, consider your budget. Insurance coverage costs can differ depending upon the insurance policy and the insurance coverage company. It is essential to discover an equilibrium between the coverage you require and what you can afford. Analyze your financial situation and figure out just how much you're able and prepared to spend on insurance costs. Remember that while it is essential to save cash, it's just as vital to have sufficient insurance coverage to safeguard yourself and your properties.

Tailoring Insurance Plans to Fit Your Way Of Life

When it comes to suitable insurance coverage policies to your way of living, we've got you covered. At our insurance coverage company, we recognize that each individual has unique needs and preferences.

For the daring spirits that like to explore the great outdoors, we provide thorough protection for all your outdoor activities. Whether you enjoy hiking, skiing, and even severe sporting activities, our insurance policy policies will provide you with the satisfaction you need to fully appreciate your journeys.

If you're a house owner, we have insurance coverage that can protect your most valuable possession. From insurance coverage for natural disasters to responsibility defense, we'll make sure that you are well-prepared for any type of unexpected scenarios.

For those who favor a more kicked back way of living, we have insurance policy alternatives that cover all your needs. Whether you're an enthusiast of great art or a wine aficionado, we can supply you with specialized coverage to safeguard your important ownerships.

With our tailored insurance coverage solutions, you can have unrivaled tranquility of mind understanding that you are totally secured. Contact us today and allow us help you find the insurance coverage plan that fits your lifestyle like a glove.

The Benefits of Personalized Insurance Coverage Insurance Coverage

Our customized insurance protection offers countless benefits to fit your distinct way of life. When it concerns safeguarding what matters most to you, having a plan that is customized to your particular needs can make all the difference. With individualized protection, you can have tranquility of mind understanding that you are safeguarded in the occasion of unexpected situations.

Among the primary advantages of individualized insurance policy coverage is that it permits you to pick the insurance coverage alternatives that are most essential to you. Whether you need protection for your home, auto, or other important properties, our personalized plans can be personalized to fit your specific requirements. This means that you only pay for the protection that you in fact need, conserving you cash visit site in the lengthy run.

Another advantage of individualized insurance policy protection is the adaptability it supplies. Life is frequently altering, and your insurance coverage requires might alter in addition to it. With personalized coverage, you have the capacity to readjust your plan as your circumstances transform. Whether you need to include added coverage or get rid of unnecessary options, our group is below to assist you every action of the method.

In enhancement to these advantages, personalized insurance coverage also offers outstanding customer care. Our team of experienced professionals is committed to giving you with the highest degree of solution and assistance - Liability Insurance Eden Prairie. We are here to address any kind of questions you might have, assist you with claims, and ensure that you have the insurance coverage you need when you require it

Discovering the Right Insurance Coverage Supplier for You

Locating the best insurance service provider can be a tough task, but it's necessary to ensure that you have the protection that satisfies your certain needs. Do you require auto insurance coverage, home insurance coverage, or possibly both? By taking the time to find the right insurance policy carrier for you, you can have tranquility of mind knowing that you are adequately safeguarded.

Achieving Satisfaction Through Comprehensive Insurance Coverage Solutions

Having comprehensive insurance coverage can offer you a complacency and protection. When unexpected occasions occur, such as crashes, all-natural calamities, or theft, having the best insurance policy can help offer and decrease the monetary worry satisfaction. With extensive insurance options, you can relax simple understanding that you are monetarily secured against a variety of threats.

Among the major benefits of detailed insurance is its capability to customize protection to your specific requirements. Insurance coverage suppliers supply various levels of protection, permitting you to pick the one that fits your way of life and budget. By functioning very closely with an insurance specialist, you can personalize your policy to include the specific protections that matter most to you.

Final Thought

So, whether you're a home owner, an automobile proprietor, or just seeking to secure your liked ones, make certain to insure with self-confidence. With customized insurance solutions that fit your lifestyle, you can delight in unrivaled assurance. Do not work out for common protection - find an insurance policy supplier that understands your distinct needs and uses extensive remedies. By taking this action, you'll be well on your method to accomplishing the comfort you are worthy of. Beginning protecting what matters most reference to you today.

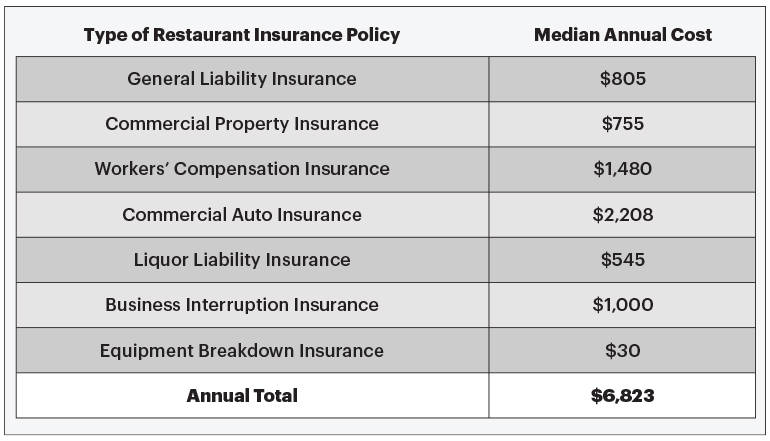

You need to recognize your insurance requires so that you can choose the appropriate insurance coverage for your details circumstance. There are different types of insurance coverage policies, such as wellness, life, home, car, and organization insurance policy. Insurance premiums can differ depending on the insurance coverage and the insurance coverage service provider.One of the major benefits of personalized insurance protection is that it allows you to pick the protection choices that are most crucial to you. Do you need vehicle insurance coverage, home insurance policy, or probably both?

:max_bytes(150000):strip_icc()/WholeLifeInsurance-273c776c0b234dbbb2bbfef4f71954de.jpg)

:max_bytes(150000):strip_icc()/how-much-does-health-insurance-cost-4774184_V2-f7ab6efc9c5042d3aedcbc0ddfc6252f.png)